Search This Supplers Products:fabric inspection machinefabric rolling machinefabric folding machinefabric cutting machinewarp beam trolleybeam stacker

- Home

- About us

- Products

- Faqs

- Fabric Inspection Machine

- Fabric Folding Machine

- Fabric Cutting Machine

- Beam Stacker

- Digital Counter Meter

- Fabric Relaxing Machine

- Tubular Fabric Reversing Machine

- Tubular Fabric Slitting Machine

- Automatic Tube-Sewing Machine

- Hydraulic Warp Beam Trolley

- Motorized Warp Beam Trolley

- Cloth Roll Trolley

- Warp Beam

- SUNTECH Service

- Fabric Rolling Machine

- Fabric Roll Packing Machine

- Accessories

- Batcher Machine

- News

- Certificate

- Contact us

2016 Cottons Trends

publisherDebbie Zhang

time2016/06/20

- With the usage of spinning raw materials decreased, the cost of man-made fibers tends to reduce. This is great news for the textile and clothing producers, and this situation is likely to continue into next year. To be sure, even if the cost of these basic industries has declined, it is impossible to exceed last year. Although the industry expects global demand will be a small level of growth, but there is no indication that the price will rebound.

With the usage of spinning raw materials decreased, the cost of man-made fibers tends to reduce. This is great news for the textile and clothing producers, and this situation is likely to continue into next year. To be sure, even if the cost of these basic industries has declined, it is impossible to exceed last year. 2014 cotton and man-made fiber prices were reduced by 10% and 3%. Moreover, although the industry expects global demand will be a small level of growth, but there is no indication that the price will rebound.

Taiwan official expects world cotton sales will increase by 3% to flat man-made fibers and expected returns. This man-made fiber industry in Taiwan is so optimistic, for two reasons: First, adequate capacity and petrochemical feedstock costs are relatively constant; the second is any price increase, almost every condition limited. It is noteworthy that, even as viscose and acrylic resins such material balance supply and demand in recent months prices have declined. In any case, the industry is expected to Taiwan in the coming year, man-made fiber prices overall downward trend. This is not nothing new, offer three years are relatively low. Also worth noting: For decades, the per capita annual consumption growth of man-made fibers less than 1%, far below the general rate of inflation throughout the region.

As described above, the cotton market has experienced the same situation, the main reason is the market supply instability. In fact, global cotton stocks that last year, cotton prices fell sharply. For example, at the end of the marketing year, the global cotton stocks are about 110 million large package, 8% higher than last year, higher than in 2010 when a shortage of natural fibers 2 times. At the same time, concern the global cotton stocks / usage is expected to reach a new high of 99%, which is almost year-round supply of cotton, far exceeding the 94% of last year's valuation. To be sure, for the upcoming 2015-16 marketing year, cotton stocks estimated to be slightly reduced. But Cary, North Carolina, the company is still declared: historical standards, stocks will continue to rise next year, high enough to make cotton prices do not rise. Ultimately, should the weak price of cotton, rayon raw material price and the total cost was flat, the industry's biggest cost spending will continue to decline overall. According to reports, raw material costs account for about 50% of the sales amount, representing approximately 43% of garment manufacturers production costs are much lower than a few years ago.

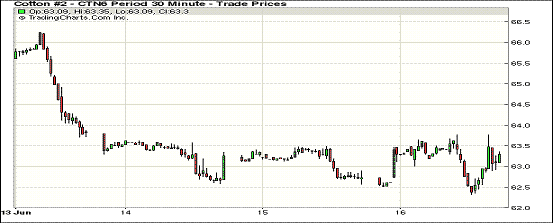

6-17, New York cotton rebounded in recent months contract ended six consecutive days of declines to rise again; 1607 month contract 63.30 cents / lb, up 70 points; 1612 month contract 64.93 cents / lb, up 131 points. Day morning cotton remained stable, selling increases USDA export report was released, the contract price bottomed after falling. June 3 to 9 week, the contract fell US cotton, upland cotton this year and next year the sum of 118 700 contract package, compared with 247,400 the previous week decrease, the amount of upland cotton contract this year to its lowest in nearly six weeks. Upland cotton contract this year the total reached 103% of the USDA forecast.